Osman MİCAN[1]

ABSTRACT

The influence of the globalization changed the structure of the economical investment on the world. Companies for increasing their profit maximization preferred to shift their capital another economically attractive countries. Rate of growth of the country who attract these investments themselves is effective for chosing the best option for companies. Developing countries need investment because of unsufficiency of the domestic capital formation. The thing which we can propose to these developing countries for decreasing deficit rate is to attract “Foreign Direct Investments”. Foreign direct investments shall effect the employment, economic growth, balance of payment and inflation in the country who attract them. In this concept, we will lok at the foreign direct investment history of the Turkey as a developing country from the first establishment period to today’s Turkey. Especially by touching important political issues which have so effective influence on the rate of foreign direct investments

KEY WORDS: Foreign Direct Investments, Developing countries, Development, Turkey, Company

ÖZET

Globalleşmenin etkisiyle dünyada ekonomik yatırımların yapısı değişti. Şirketler kar maksimizasyonu sağlamak amacıyla ekonomik olarak daha çekici ülkelere sermayelerini kaydırmayı tercih ettiler. Yatırımları çeken ülkenin kalkınma oranı yatırımcının en iyi seçimi yapmasında etkilidir. Yurtiçi sermaye birikiminin eksikliğinden dolayı gelişmekte olan ülkelerin yatırımlara ihtiyacı vardır. Bu gelişmekte olan ülkelere açıklarını kapatmaları için doğrudan yabancı yatırımları önerebiliriz. Doğrudan yabancı yatırımlar bulundukları ülkede istihdamı, ekonomik kalkınmayı, ödemeler dengesini ve enflasyonu etkileyebilir. Bu bağlamda, Türkiye’nin gelişmekte olan bir ülke olarak cumhuriyetin ilk yıllarından günümüz Türkiye’sine doğrudan yabancı yatırım tarihini inceleyeceğiz.

ANAHTAR KELİMELER: Doğrudan Yabancı Yatırımlar, Gelişmekte olan ülkeler, Kalkınmak, Türkiye, Şirket

1.Giriş

At the countries which are accept as developing ones, for implementing a sufficient economic development, they have to save important amount of their revenue for the investments. From the formule of “S = I[2]”, the main source of these investments are savings. At most of the developing countries, GDP is not so high because of that their saving rate less than rate of spending. Because developing countries like Turkey, people spend most of their revenue to the vital needs of themselves. Beside that, disposition of the people who have low amount of budget have high passion of spending. Think about a garbage man whose salary is 1500₺ and have really poor appereance. When you gave him premium probably he wont hide it and spend all of them for phone, tablet etc. however not spend it for the clothes which are more important than others for him.

Due to low rate of the domestic capital formation, countries shall not increase investments, provide economical growth and as a result of them maintain the situation as a poor country whose national rate of revenue is too low. There are three way for breaking this source or saving deficit and provide development. (A) External borrowing and foreign assistance, (B) Foreign direct investments and (C) Portfolio investments. Investments like external borrowing and foreign assistance can close the domestic saving gap. Total rate of domestic saving can increase and by this way country can make much more investment. (DİCKEN)However, maintainance of the economic growth which provided by external borrowing, too hardfor long term. Because country will pay back these money with extra interest to capital. Portfolio investments which known as indirect investment entrance to country is short term investments. When these kind of investments confront with a financial situation which cause to an unstability at the country can leave there and shift its capital to more attractive countries as quickly as possible. The countries which went through economical problems can be seen as example. Beside both type of investment, foreign direct investment have different character itself. Investment like that have so importantcontribution to economical development of the country.

Foreign direct investment increase the production capacity and foreign exchange receipts, provide technological transfer, improve the human capital investments and contribute perpetuation of modern principles of managerialism. Foreign direct investment compare to others, effective method for closing deficit. Foreign direct investments as an effective method to close deficits take into consideration lots of parameters. From cheap labor, advantages of tax, developed infrastructure, legal and institutional improvement degree to economic and political stability are from the important parameters which constitude the best option for foreign direct investments.

From the establishment of the Turkish republic, need of the investment at the high level. Turkey, from establishment days to today’s Turkey tried to attract foreign direct investments and planned to reach statue of a developed country. These ventures for attracting them sometimes became unsuccesful because of the political issues at the republic. However, altough the unsuccessfulnesses, rate of the investment increased and helped the development of the republic.

At this article The aim is to make answer “What is foreign direct investment?”, “Does is beneficial or not?”, “Do this kind of investment beneficial or harmful for the country?” and to learn historical process of Turkish republic about attracting country foreign direct investments. All of them are going to become explained by graphics.

2.Definition of Foreign Direct Investment and its Determinatives

Globalization, process of internalization of the goods, services, financial markets, investments, technology, production factors, informations, education, ideas, democracy, culture, health, law, politics and common values like environmental factors by going beyond the regional and national borders. In that concept, all countries dependant to themselves.[3] Economic interdependancy one of the most important between all of them. With appereance of economic interdependancy, foreign direct invgestments occured. There are three dimension of international complex interdependancy. First one is traditional way which is international trade in goods and services for effecting each other. At that way financial issues at a country where you have financial linkages shall effect you. Second one is trade of financial assets such as equity and bonds. Movements of financial assets have important role. They can communicate financial shocks which realized one country, to anothers. Third one is the internalization of production through foreign direct investments. These investments realized by Multinational co mpanies.[4] Important amount of the output like %70 pruduced by multinational companies.[5]

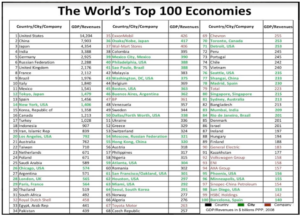

Table 1: The World’s Top 100 Economies[6]

Multinational companies(MNE’s) or with its other name Transnational companies(TNC’s) have activities at two or more countries with units which are dependant to itself, for providing profit maximization. As a result of the of the technological developments and liberalization activities which are at the internatiol degree, multinational companies gained acceleration. At today’s world some multinational companies have much more income than the countries.

Foreign direct investment done by considering long term interest of a company which realized investment within the foreign local company. There are 2 main indicator for understanding long or short term investments. First one is the close relation between the investors. Second one, explicit effect of the foreign direct investment on local national company. Numerically, for evoluating as foreign direct investment multinational company at least have %10 percent of the share or right to vote at the decision taking process.[7] At the same time to make new investment with capital by obtaining credit or revenues which come from avaliable investments, capital transfers which is between parent company and branch of it.[8] Measurement of the foreign direct investment done with two way. First one is stock measurement which is total reserves and capitals of a company at foreign countries. Second one is measurement of flow which is the total value of foreign direct investments at defined period of time.[9]

1.Size of The Market

The size of the market defined according to GDP of the country. Size of market, so important for the investors because market which has adequate size rate can provide satisfactory profits. Investors usually prefer huge sized markets.[10]

2.Openness

Openness, defined according to rate of capacity of foreign trade. This rate construe as a criterion for commercial limitation. However, this sometimes can be better for some host countries although most of the host countries prefer open economies. In such a way that, if the investment company wants to serve to local economy of the host country and because of the commercial limitation importing its goods is too hard for them, they can establish a branch at that country. Altough the companies which have import propensity perefer commercial limitations, companies which have export propensity prefer open economies.[11]

3.Cost of Workmanship and Labour Productivity

Cost of workmanship have so much importance for the investment companies especially if theirproducing process depend on labor. Accordingly, for providing profit maximization investment company prefer regions which have cheap labour and low rate of unionizing. If there is not much change about the cost of labour country to country, companies prefer regions whichhave more qualified and productive labour.[12]

4.Closeness

The freight rate and foreign direct investment flows have inverse proportion between themselves. For this reason, for the foreign direct investment decision, it is important to take in to consideration closeness.[13]

5.Infrastructure System

There is direct proportion between developed infrastructure system and rate of foreigndirect investments. Developed infrastructure system which includes highways, harbours, communication systems etc. Increase the productivity of the investments.[14]

6.Encouragement and Operating Conditions

Countries can attract companies by giving some encouragements to investment companies. Generally, low tax rate, behave equal in the market like how country behave its local companies at market. [15]

7.Trade Deficit

One of the most important thing for foreign direct investment is trade deficit. According to Torissi (1985), Frey (1985) and Hein (1992) trade surplass contrary to deficit take muchmore foreign direct investment.[16]

8.Technological Competition

Countries which have technological sufficiency get more foreign direct investment compare to others who have not technological sufficiency.[17]

9.Life Quality

Determining factors of life quality are rate of literacy, rate of phone, radio and automobile users according to population etc. Urbanization level have direct proportion with industrial capacity and life standarts of the population.[18]

10.Geo-Cultural Distance

Cultural distances between two countries may effect the investment because similarities may make commercial affairs and increase the reliability. By this way, rate of flow of foreign direct investment increase.[19]

11.Political Risk

For the foreign direct investment most disquieting things are political instabilities. Short term governments, weak coalitions, coup attempts are causes of the political instabilities. Long term government much more effective about getting foreign direct investment.[20]

Table 2: Foreign Direct Investment Determinents[21]

3.The Effect Of The Foreign Direct Investments

Effect of the foreign direct investment shall investigate under the topics below mentioned.

1.Increasing Of The Capacity Of Production And Employment

The rate of production capacity is low because of the lackness of the capital of devoloping countries. At the same time, have low rate of usage of production capacity. Multinational corporations by making investments increase the capital formation so increase the capacity of production.

2.Effect On Currency Revenue

Developing countries for producing final goods need intermediate goods which imported. The country like Turkey, if foreign-source dependency, the tendancy to import incerease. Inevitable end for this kind of countries is current deficit. Foreign direct investment can close this deficit by the currencies which come with them. The most reliable way to close this deficit accept as foreign direct investments. The important thing here is the amount of currency which hold in host country.[22]

3.Increasing Of Export

The multinational corporation have much more advantage and experience about exporting according to local companies. So multinational corporation by selling their product foreign countries increase the rate of export in host country.

4.Increasing Of Tax Revenue

Increasing of the economical activities of muştinational corporation in home country by getting taxes can increase the tax revenue.

5.Effect Of Technology Transfer

Multinational corporations provide information flow mutually between countries. So they can effect themselves technologically. The countries which have not sufficient technologicalinfrastructure, cant reach the expected benefit from multinational companies. [23]

The most important investment for host country is technology transfer. This transfer happened at four type. First one vertical linkages between sellers and buyers of the technology; second one, horizontal linkages between rival companies or companies which are producing substitttion goods. Third one, migration of the qualified workforce;fourth one, internalization of the innovation activities.

Technology transfer happen by channels below mentioned

- Channel Of Imitation Effect: If the company become the most powerful company in its sector national companies want to be like it. Thus, a collective technological modernization began.

- Channel Of Labour Mobility: By the modernization especially technologically foreign direct investments can provide labour who are expert about using technological devices. So by the help of them qualification of labour of country. Sometimes mobility of labor can effect negatively. National local companies insufficient to compete with multinational company. Moreover multinational companies get qualified personels of the national local companies.[24]

- Channel of Rivalry: Power of rivalry of an economy increases according to quality of the product which you produce. Multinational companies increase this quality rate by their products which are qualified. Thus, national companies began to product new goods with rivarly motive.[25]

6.Effect On The Public Revenue

Multinational corporations by increasing production rate can increase the tax revenue. Thanks to that, increase rise of public revenue. [26]

The things abovementioned generally for positive effect of the foreign direct investments. Negative effect of foreign direct investment belowentioned.

- With the entrance of the multinational corporations to the national local markets, some of the local national companies can corrupt because of unsufficiency when compare with multinational companies. If corrupted companies don’t work with high rate of productivity there can be nothing macro scale. However, the related company have high rate of productivity this mean is corrupt will decrease the power of national local companies compare to multinational companies. This situation can cause problem of unemployment.

- Some national local companies become monopoly at their sector. Multinational corporations effective to break this situation by creating rivalry between companies. However, if this multinational corporations take the monopoly role of the local national corporations this can cause corrupt of local national corporations. Thus, multinational corporations can effect performance of economic growth performance negatively.

- The shift of the innovation of the multinational companies to local natioanal companies may effect local countries economy. However, if they dont bring their innovation, our researchers who are qualified have to leave because developing countries can’t provide conditions for them everytime. Thus, they will go abroad for not being unemployed. If foreign direct investments can’t bring innovation brain drane inevitable for local country.

4.Foreign Direct Investments In Turkey

After period of lots wars which caused the collapse of Ottoman Empire and birth of Turkish Republic as a nation state which was a part of empire. Turkish republic for developing beside lots of movement, firstly, had to do economical leaps. However, there were any capital to realize this planned leap because, all capitals and the commercial activities on hand of the non-Muslims. The aim of the republic firstly, to form a local merchant class beside all economic misfortune. Cadre of the republic shortly wanted to nationalize economy. Especially nationalized the sectors (railways, see transfer etc.) which gave public services.[27] Thus, that movement seem as administrators against to foreign direct investment but reality was different. Mustafa Kemal Atatürk for breaking that perception said these words at Izmir Economic Congress “Masters, when you are thinking economically and talking, don’t suppose that we are adversary to foreign capital. No, our country is wide. We need much labor and capital. We are always ready to give the guarantees which are necessary for foreign direct investment but if they obey our conditions and we eish their existence in our labour and revenue. Provide for us and them beneficial results; but not like old time.”. [28]

As parallel to these discourses administrators enacted new laws. In that concept, in 1924, Istanbul Seydiköy Gas and Electricity Company (with capital of Belgium), Izmir Telephone Company in 1925 (Sweden), Izmir Electricity and tramvay Company in 1926 (Belgium), Zingal Forestry Company in 1927 (Belgium), Gunes Manganez Mining Company (German), Kireçlik Krım Mining Company (French), Adana Electric Company (German), Ankara Electricity and Gas Company (UK), Fethiye Silvery-Lead Mining Company (French) in 1928, Ford Company ) and Coal Mining Company (French) were exclusive multinational companies at that period.[29]

Beside these between 201 Turkish joint stock company, foreign direct investments available at 66 of them and they had the %43 share at the total capital.[30]

After some periods which passed with liberal policies, administrators found out that these policies didn’t bring success economically to the country. Of course, the effect of Soviets success by their statism policy and the Great Depression had a serious role on that. This situation caused that seeking of liberal policies to the statism.

Changes at the conjuncture between 1930-1950, serious decrease realized at the rate of foreign direct investment. The number of foreign direct investment was 12 billion ₺ in 1929 but in 1931 this number decreased under 1 billion₺.[31]The reasons why foreign direct investments decreased insofar were Great Crisis and 2. World war. These two were foreign effects. Lastly, nationalization of the sectors by the effect of statism which showed itself after the 1930’s. Especially public services which were railways, ports, municipal services and mines nationalized. Closed policy by the Turkish republic could be seen from one of the radio speech of the Celal Bayar; “We wont give the beauty of the industrializtion to the ‘ecnebis’ when thw youngs of the our nation work for it. Country wont be at the side of somene only will work for itself”[32] .Although these policies, Turkey got 32 new multinational corporation between 1934-1938 which were the most dominant years of statism in Turkey.

Republican People’s Party from 1930 to period of multi-party period maintained statist policy up until a the party which came with liberal discourses. RPP enacted 5583 numbered law Law Which Preliminary Private Establishment And Forwarding of Foreign Exchange and 5921 numbered law not to lose ballads and to suit world economic system which supported foreign direct investments after the 2.World War in 1 March 1950.[33] However, it didn’t work properly and RPP lost the race of government. With coming of the Democrat Party (DP), they enacted 6224 numbered law which name was Law of Foreign Investment Incentives. Thanks to this reform, lots of multinational company made investment especially at automotive, food, white goods, medicine sectors in the 1960’s. Economy shifted from liberal policies to planned policies. And with this five year development plans, financial credits went in someone’s favour of the local national companies.[34]

In the frame of industrialization some of the local national companies by the support of the state became powerful. Even they could interfere to industry policies of states. These companies didn’t get the multinational companies which could be rivalry to them but got multinational companies who could make common entrepreneurships with them with using the support of the state. Fiat (1954), BMC (1964), MAN (1966), Mercedes (1966) and Renault (1969) in the automotive sector; In the pharmaceutical sector, Sandoz (1956), Pfizer (1957), Roche (1958), Bayer (1962); in the BEYAZ EŞYA sector, AEG (1964), Si-emens (1964), Bosch (1970); The food sector, Pepsi (1964), Coca-Cola (1965) and Tuborg (1967); Pirelli (1960) and Goodyear (1961) were the coming multinational companies to Turkey.[35]

After the declaration of Turkish Republic up until the Democrat Party period total foreign direct investment was 2,8 million $. After the liberal policies and incentives of the government total foreign direct investment rised to 5 million $. Investments decreased when Turkey confronted with the coup of 1960. Altough coup, after 2 years Turkey started to get foreign direct investments. As indicator of success, Turkey at 1964 reached the top foreign direct investment number with 10 million $.

Table 3: Foreign Direct Investments from 1954 to 1980[36]

In the economic reform proposal of Atilla Karaosmanoğlu who was at the cabinet of Nihat Erim which formed after 17th March 1971 Memorandum, effected the foreign direct investments. In this propossal there were reform of land, tax of land and nationalization of the sector of mining beside these, there were some proposals which effected the foreign direct investments. Proposal was about the rate of the share of foreign direct investment. In that concept at least %51 of the total capital share had to be owned by local national companies. Actually basic aim of this proposal to protect national companies and encouraged them but except Bülent Eczacıbaşı and Vehbi Koç any company couldn’t benefit from that.[37]

Even though there were multinational corporations who were partners of big companies and making investments, especially the politic unstability (world petrolium crise, conflict of cyprus, tensions at politics) after 1970’s, decreased the rate of foreign direct investments.

After the coup of 12 September and 24 January decisions Turkey passed to liberal economic policies which based on exporting. Military regime for decreasing the suspection on them and for gaining legitemacy maintained the neoliberal policies which started with the 24 January Decisions.

After 24 january, as first duty they established Circle Of Foreign Capital which is dependent to prime ministery. At the same time, Foreign Capital Framework Decree with the amendments, made much more liberal at 1980, 1984,1986 and 1995.[38]The economic policies maintained at the period of Motherland Party (MO) government. Reason of that were liberalizatiom of foreign trade and financial markets. At 1984, buying and selling foreign exchange liberalized. Purpose was making more liberal finance markets. In that concept, at 1989 cambium controls abolished and capital movements liberalized, totally.

Foreign direct investments showed increase after 1980 at liberalization period. After a long time firstly, foreign direct investments were on the 1 billion $ in 1989. The effect of the finance market was also important. In 1989 the occupational entrances were 663 million $. The reason why there was a classificaon like empoweree and occupational. Most important factor between them was the realization period of the foreign direct investments. Most of times foreign direct investments couldn’t be finish at agreed time so maintain other yeears. Another reason which created the differance empoweree didn’t transform into an investment.

Despite the fact that, there were increasing about the foreign direct investments, at the same time short termed speculative capital movements increased because of liberalization without establishing necessray corporate and juridical infrastructure. At that period, even there were the infrastructure of Savins Deposite Insurance Fund, Law Of Banking, Capital Market Law, the liberalization of financial markets caused serious problems without well established laws and institutions and tries. Consequently, in Turkey an economic system which based on interest- currency exchange and drive forward speculative gaining, occured.[39]

The reason why foreign direct investment fell behind of short term speculative foreign investment were the risk of the political environment, lackness of financial auditing basics and weakness of right of property.[40]

The reason why Turkey at the period of Motherlan Party couldn’t get much foreign direct investments were lackness of infrastructure institutionally and juridical beside political tensions. Multinational corporations prefer not to enter market only themselves because of complex bureocratic rule. They prefer partnership which were not high rate and have low rate of risks.[41]

Result of unplanned neoliberal reforms, banking sector passed the hand of big companies. Private banks used their available fund for their subsidiary and interest of themselves.

This situation mostly effected Small and Medium Sized Enterprises (SME) which could not provide their foreign financial need. Herewith, foreign capitals which entered the country behind of short termed & speculative profits and problems of banks about realizing their exact duty effect mostly Small and Medium Sized Enterprises. this situation provide benefit to big companies and foreign capitals beside Small and Medium Sized Enterprises.

The economic import substutition development strategy didn’t work properly so there had to be a change at the economical system. Even the decisions of the 24 january necessary for the Turkey, because of the some timing and ordering faults, bureocratic inadiquencies and ventures of big holding for using the state for their interests caused not getting sufficient output. Turkey’s economy could’t take a big step altough all of the reforms at 1980’s. The disappointment was 1990’s for Turkey’s economy.1990’s the lost 10 years of Turkey’s economy.

Foreign direct investments maintained to increase even its rate under the expected numbers at the beginning of 1990’s. Comparation according to rate of GDP, Hungary took 13 times more foreign direct investments than Turkey between 1988-1995.[42]

Crisis of the 1994 influenced the increase rate of the foreign direct investments. In contrast with that, the government of the period who were cabinet of the Tansu Çiller signed Custom Tariffs Treaty and enacted 5 April Decisions. Even they did these one, there were not an important change about the foreign direct investments

The crisis at South-Eastern Asia, Brazil and Russia generally decreased the rate of foreign direct investnment at developing countries like Turkey. At the same time, unstable political situation which caused by 28 February post-modern coup and unstable coalition governments had important role about the decrease.

During the ongoing process, First time in foreign direct investment history, occupational investments of Turkey reached over 1 billion $ at between 2000-2001. Although the increase between 2000-2001 Turkey confronted with the serious decrease after the biggest crise of its history.

Table 4: Foreign Direct Investments from 1980 to 2001[43]

In Turkey between 1980-2001 empoweree foreign direct investmens %17 of the total investmnets belong to France, other countries rate as ordered; The Netherlands 14%, Germany 13%, USA 12%, England 8%, Switzerland 7%, Italy 6% and Japan 6%.

At 1980 foreign direct investments mostly made for manifacturing industry with the percentage of %92. However, at 2001 most of the investment made beside manifacturing industry for service sector, too.

Table 5: Most invested sector at 1980 Table 6: Most invested sector at 2001

Politically unstable period caused high influention and budget deficit at the beginning of the 1990’s in Turkey. The solution given by Bülent Ecevit’s coalition which formed by Democratic Left Party (DLP) – Nationalist Movement Party(NMP) – Motherland Party (MO). Thay planned to apply deflation with the support of International Monetary Fund (IMF) at 1999. Despite the fact that, this programme seem like useful, but in reality this was the collapse of Turkey economically. One of the most important reasons of the 2001 crise is the inadequency of the coalition members for execution of the programme.2000-2001 crise influenced rate of the foreign direct investment profoundly.[44]

Table 7: Foreign Direct Investments from 2002 to 2012[45]

Crise showed the necessity of powerful government beside the coalitions in Turkey. Because of the distressed process early election was inevitable. Result of the election was majority which Turkey rarely confront. With liberal discourses Justice and Development Party (JDP) implemented macroeconomic policies, started EU negotiations and capital whealth between the 2001-2008 on the world, Turkey grow rapidly. Thus, with this new economic order foreign direct investment increased directly proportional

The Period after the 2001 for establishing a better investment environment big steps taken. One of the most important one is 4875 numbered Foreign Direct Investment Act at 2003.The aim of the 4875 were to regulate foreign direct investment, to protect rights of foreign investment companies, to move according to international standarts, to abolish obligation of permission and increase the foreign direct investments with proper policies.[46] Not only 4875 but also 4817 numbered Law On Work Permits Of Foreigners which sweeted up to deal conditions for alien labours and 4686 numbered International Arbitration Law which provided investment company right to apply arbitration for the solution of the juridical problems.[47]There were 85 country who signed The Law Of Mutual Protection And Promotion Of Investments, 76 country signed Avoidance Of Double Taxation Treaty and 19 country who signed Free Trade Agreement with us.[48]

Table 8: Countries who signed mutual protection of investments and incentive law with Turkey

During the ongoing processes, Turkey started to increase foreign direct investment rate in 2005. However, more than %50 percent of this investment is real property. Investment of real property only for one time so not accept as long termed investment for host country. Turkey with the legal changes tried to prohibition of real property investment. Thanks to that, foreign direct investment influenced negatively from the legal changes and important decrease seem in 2016 second quarter. At 2007, Turkey reached the top point in its history, with 22 Billion $. However, with the global financial crise in 2008 foreign direct investment influenced seriously. This influention not for the Turkey but also for other countries. Turkey approximately 1-2 year felt the effect of this 2008 crise but after this period started to attract more foreign direct investment again in 2010. At statistic of the 2011 economic recovery observable. At 2012, 2013 and 2014 there were only little fluctuations but in 2015 number started rise again.

Tablo 9: Countries which make investment 1954 to 2012

Tablo 10: Countries which make investments 2012 to 2017[49]

Although Turkey confront with a coup attempt in 2005 with the logical and strong economic system and interference administrator of the Turkey successed to sustain the country.

5.Conclusion

The importance of the multinational companies in today’s world which live the process of globalization, inevitable because of their role on the economy. Multinational companies as a main actor at the global economy they can control and with their flexibility can shift economic sources from one to another place basically.

The biggest problem of the developing countries insufficiency of capital because of inadequency of savings. Beside this psychic costs, if there are technological insufficiency, adequate prduction cant done, GDP cant increase, cant open new employment area by countries. Because of the problems that occured, countries by making some administrative and legal regulations have to attract foreign direct investments for providing their development, increasing the production, finding a solution for unemployment, widening the reserve of the currency, have to establishing a system which is based on rivalry in the market, bringing new production methods.

Foreign direct investments have important contribution to production capacity, increase of productivity, modernization of the local companies, technological transformation and employment.

The foreign direct investments movements started properly in Turkey after 1950 but specifically after 1980’s. Because after 1980’s there are lots of regulations and developments. With these kinds of things Turkey started to attract foreign direct investments much more because of established environment of trust.

The process maintained like that up until the 2002 especiallly up until the eletion victory of the AKP which is at the same time majority government. After this elections different from the period before 2000 especially 1990’s which is a period of coalitions saw the power and stability of majority governments.

The government which has power prevented the unstability of economy like new implementing economic policies. At this period retreatment of the rate of interets slowly decreasing of the bureocratic obstacles and preparing suitable environment for foreign direct investments realized.

Consequenly, to attract foreign direct investment is really important for countries. State economy policies have to implement carefully for not remove local companies when attracting foreign direct investment. At the same time foreign direct investments have accept under defined condition with the control of the state at defined sectors. For benefit from them.

[1] ISTANBUL MEDENIYET UNIVERSITY/FACULTY OF POLITICAL SCIENCES/POLITICAL SCIENCE AND PUBLIC ADMINISTRATION/2.GRADE

[2] Saving = Investment

[3] Complex Interdependacy Theory

[4] Jansen, W. Jos and Ad C.J. Stokma (2004), “Foreign Direct Investment and International Business Cycle Comovement”, European Central Bank Working Paper Series, No:401, pp.7-8

[5] Steger B.M. (2006), Küreselleşme, Dost Kitabevi, Ankara

[6] CIA World Fact Book (2015), The World’s Top 100 Economies

[7] Gedikli, A, and Seyfettin, E. (2016), Türkiye’ye Yönelik Doğrudan Yabancı Yatırımlar. 1st ed. Pp. 279

[8] Jansen, W. Jos and Ad C.J. Stokma (2004), Foreign Direct Investment and International Business Cycle Comovement, European Central Bank Working Paper Series, No:401 pp.8-9

[9] DEİK (2012), Dünya’da ve Türkiye’de Yurtdışı Doğrudan Yatırımlar, Yurtdışı Yatırımlar Çalışma Grubu. Pp.7

[10] Asiedu, E. (2002), “On The Determinants of Foreign Direct Invessttment to Developing Countries”, World Development, Vol:30, No.1, pp.107-119

[11] Gövdere, B. (1997),” Doğrudan Yabancı Sermaye Yatırımlarının Günümüzdeki Geçerliliği”, Dış Ticaret Dergisi, Sayı:6, pp.1-9

[12] Gedikli, A, and Seyfettin, E. (2016), Türkiye’ye Yönelik Doğrudan Yabancı Yatırımlar. 1st ed. Pp.286

[13] Özyıldız, R. H. (1998), “Doğrudan Yabancı Sermaye Yatırımlarında Karar Alma Prosedürü”, Hazine Dergisi, Sayı:11, pp.12

[14] Sun, Q. W. Q. (2002), “Determinants of Foreign Direct İnvestment Across China”, Journal of İnternational Money and Finance, Vol.21, pp.79-113.

[15] Çetintaş, H. (2001), “Global Bir Ekonomide Doğrudan Yabancı Yatırımlar ve Rekabet”, Dış Ticaret Dergisi, Sayı:22, ss.1-7.

[16] Teng, J. M. S. K. (2001), “Entry Strategies for Multinational Enterprises and Host Countries”, European Journal of Operational Research, vol.133, pp.62-68.

[17]Kurtaran, A. “Doğrudan Yabancı Yatırım Kararları Ve Belirleyicileri.” pp. 374–376., e-dergi.atauni.edu.tr/ataunisosbil/article/viewFile/1020000446/1020000440.

[18]Kurtaran, A. “Doğrudan Yabancı Yatırım Kararları Ve Belirleyicileri.” pp. 374–376., e-dergi.atauni.edu.tr/ataunisosbil/article/viewFile/1020000446/1020000440.

[19] Braunsteın, E. (2000), “Engendering Foreign Direct Investment: Family Structure, Labor Markets and International Capital Mobility”, World Development, Vol.28, No.7, pp.1157-1172.

[20]Gedikli, A, and Seyfettin, E. (2016), Türkiye’ye Yönelik Doğrudan Yabancı Yatırımlar. 1st ed. Pp.287

[21]UNCTAD (1998), World Investment Report: Trends and Determinants. New York: United Nations.

[22] ÖZCAN, B. and Ayşe A. (2010), “Doğrudan Yabancı Yatırımların Belirleyicileri Üzerine Bir Analiz: Oecd Örneği.” İstanbul Üniversitesi İktisat Fakültesi Ekonometri Ve İstatistik Dergisi, vol. 12, pp. 70–71.

[23] Gür, N, Yrd. Doç. Dr. (2014), “Doğrudan Yabancı Yatırımların Yerli Şirketler Üzerine Etkileri.” Müsiad Araştırma Raporları, 90, pp.42-45. http://www.musiad.org.tr/F/Root/burcu2014/Ara%C5%9Ft%C4%B1rmalar%20Yay%C4%B1n/Pdf/Ara%C5%9Ft%C4%B1rma%20Raporlar%C4%B1/90-Dogrudan_Yabanci_Yatirimlar.pdf.

[24] Gedikli, A, and Seyfettin, E. (2016) Türkiye’ye Yönelik Doğrudan Yabancı Yatırımlar. 1st ed. Pp.284-285

[25] Melnyk, L. O. Kubatko, S. Pysarenko, “The İmpact Of Foreign Direct İnvesrment On Economic Growth: Case Of Post-Communism Transition Economie”, Problems and Perspective Management

[26] Gedikli, A, and Seyfettin, E. (2016), Türkiye’ye Yönelik Doğrudan Yabancı Yatırımlar. 1st ed. Pp.284

[27] Kılıç, G. K. (2007), Türkiye’ye Doğrudan Gelen Yabancı Sermaye Yatırımlarının İstihdam Üzerindeki Etkileri, Uzmanlık Tezi, Ankara, http://statik.iskur.gov.tr/tr/rapor_bulten/uzmanlık_tezleri/(Erişim Tarihi: 20.11.2017).

[28] Erdilek, A. (2011),” Türkiye’nin Osmanlıdan Günümüze Kadar Uzanan Doğrudan Yabancı Yatırım Ortamına Ve Politikalarına Tarihsel Bir Bakış”

[29] Tezel, Y.S. (2002), Cumhuriyet Döneminin İktisadi Tarihi (1923-1950). İstanbul: Tarih, Vakfı Yurt Yayınları.

[30] Görg, H. ve Greenaway, D. (2004), “Much Ado About Nothing? Do Domestic Firms Really Benefit From Foreign Direct İnvestments?” .World Bank Research Observer, 19(2), 171-197.

[31] Tezel, Y. S. (2002), Cumhuriyet Döneminin İktisadi Tarihi (1923-1950). İstanbul: Tarih, Vakfı Yurt Yayınları.

[32] Karluk, R. (2004), Türkiye Ekonomisi Tarihsel Gelişim Yapısal Ve Sosyal Değişim, Beta Basım Yayın, Tıpkı 8. Baskı

[33] Şahin, M. (1975), “Türkiye’de Dolaysız Sermaye Yatırımları”, Ekonomik Sosyal Yayınlar Serisi, No:3, Ankara

[34] Marois, T. (2013), Devletler, Bankalar ve Kriz: Meksika ve Türkiye’de Yükselen Mali Kapitalizm. Çeviren: Beyza Sümer Aydaş, Ankara: Nota Bente Yayınları.

[35] Yavan, N. Ve Kara, H. (2003), “Türkiye’de Doğrudan Yabancı Sermaye Yatırımları Ve Bölgesel Dağılışı”. Coğrafi Bilimler Dergisi, 1(1), 19-42.

[36] Gür, N, Yrd. Doç. Dr. (2014), “Doğrudan Yabancı Yatırımların Yerli Şirketler Üzerine Etkileri”. MÜSİAD Araştırma Raporları, 90, pp. 42-45. http://www.musiad.org.tr/F/Root/burcu2014/Ara%C5%9Ft%C4%B1rmalar%20Yay%C4%B1n/Pdf/Ara%C5%9Ft%C4%B1rma%20Raporlar%C4%B1/90-Dogrudan_Yabanci_Yatirimlar.pdf.

[37] Züchner, E. J. (1998), Turkey: A Modern History. New York, NY: I.B. Tauris.

[38] Yavan, N. Ve Kara, H. (2003). “Türkiye’de Doğrudan Yabancı Sermaye Yatırımları Ve Bölgesel Dağılışı”. Coğrafi Bilimler Dergisi, 1(1), 19-42.

[39] Yeldan, E. (2006), Küreselleşme Sürecinde Türkiye: Bölüşüm, Birikim ve Büyüme. İstanbul: İletişim Yayınları.

[40] Ünay, S. (2013), Modern Kalkınmacılık. İstanbul: Küre Yayınları.

[41] Buğra, A. (2007). Devlet Ve İş Adamları. İstanbul: İletişim Yayınları.

[42] Grigoriadis, I. ve Kamaras, A. (2008), “Foreign direct investment (FDI) in Turkey: Historical Constraints And The Akp Success Story”. Middle Eastern Studies, 44(1), pp. 53-68

[43] Gür, N, Yrd. Doç. Dr. (2014), “Doğrudan Yabancı Yatırımların Yerli Şirketler Üzerine Etkileri”. MÜSİAD Araştırma Raporları, 90, pp. 42-45. http://www.musiad.org.tr/F/Root/burcu2014/Ara%C5%9Ft%C4%B1rmalar%20Yay%C4%B1n/Pdf/Ara%C5%9Ft%C4%B1rma%20Raporlar%C4%B1/90-Dogrudan_Yabanci_Yatirimlar.pdf.

[44] Gültekin-Karakaş, D. (2009), Hem Hasımız Hem Hısımız: Türkiye Finansal Kapitalizminin Dönüşümü ve Banka Reformu. İstanbul: İletişim Yayınları.

[45] Gür, N, Yrd. Doç. Dr. (2014), “Doğrudan Yabancı Yatırımların Yerli Şirketler Üzerine Etkileri”. MÜSİAD Araştırma Raporları, 90, pp. 42-45. http://www.musiad.org.tr/F/Root/burcu2014/Ara%C5%9Ft%C4%B1rmalar%20Yay%C4%B1n/Pdf/Ara%C5%9Ft%C4%B1rma%20Raporlar%C4%B1/90-Dogrudan_Yabanci_Yatirimlar.pdf.

[46] UNCTAD (2012), Investment Country Profiles: TURKEY

[47] Example of issue between Uzan GROUP and Motorola&Nokia

[48] Sönmez, A. Ve Pamukçu, M. T. (2011), “Foreign Direct Investment And Technology Spillovers In The Turkish Manufacturing Industry”. TEKPOL Working Papers, No. 11/03.

[49] EKONOMİ BAKANLIĞI (2016), Uluslararası Doğrudan Yatırımlar 2015 Yılı Raporu